Wednesday, January 10, 2024

An Introduction to Beneficial Ownership Information Reporting

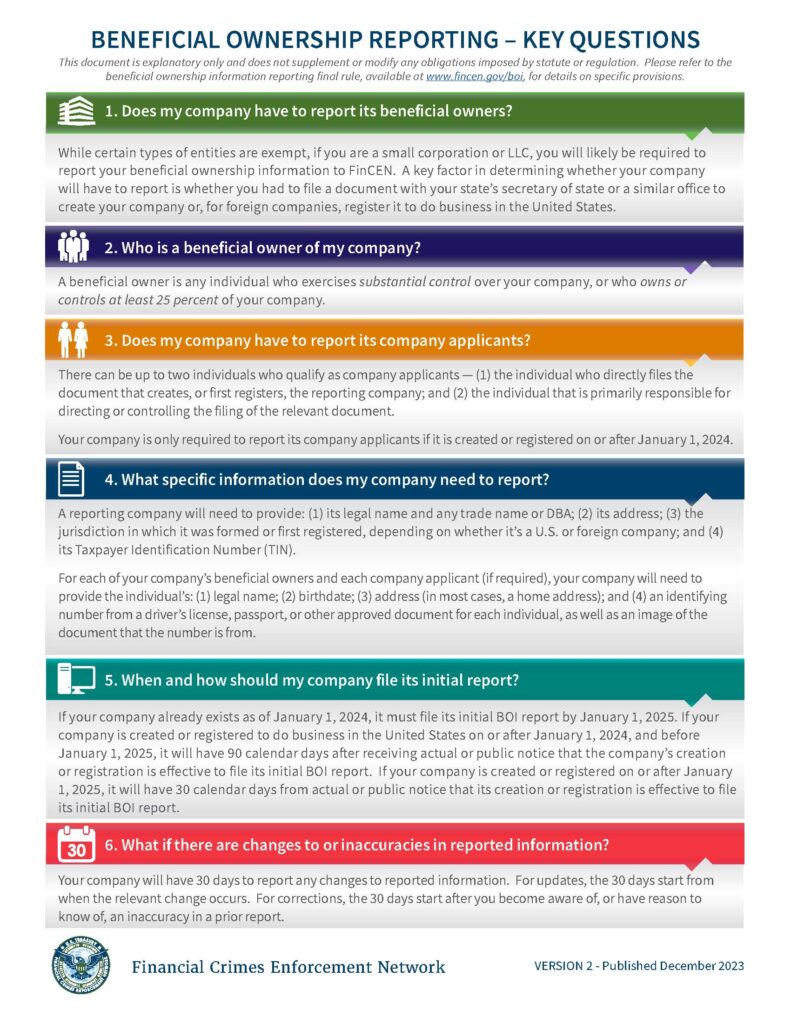

In 2021, Congress enacted the Corporate Transparency Act. This law creates a beneficial ownership information reporting requirement as part of the U.S. government’s efforts to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures.

New Federal Reporting Requirement for Beneficial Ownership Information (BOI)

As of January 1, 2024, many companies in the United States were required to start reporting information about their beneficial owners, i.e., the individuals who ultimately own or control the company. They will have to report the information to the Financial Crimes Enforcement Network (FinCEN). FinCEN is a bureau of the U.S. Department of the Treasury.

Who Has to Report?

Companies required to report are called reporting companies. Reporting companies may have to obtain information from their beneficial owners and report that information to FinCEN.

Who Does Not Have to Report?

Twenty-three types of entities are exempt from the beneficial ownership information reporting requirements. These entities include publicly traded companies, nonprofits, and certain large operating companies.

How Do I Report?

Reporting companies will have to report beneficial ownership information electronically through FinCEN’s website: https://boiefiling.fincen.gov

- The system will provide the filer with a confirmation of receipt once a completed report is filed with FinCEN.

When Do I Report?

- If your company was created or registered prior to January 1, 2024, you will have until January 1, 2025, to report BOI.

- If your company was created or registered on or after January 1, 2024, and before January 1, 2025, you must report BOI within 90 calendar days after receiving actual or public notice that your company’s creation or registration is effective, whichever is earlier.

- If your company was created or registered on or after January 1, 2025, you must file BOI within 30 calendar days after receiving actual or public notice that its creation or registration is effective.

- Any updates or corrections to beneficial ownership information that you previously filed with FinCEN must be submitted within 30 days. FinCEN cannot accept reports before January 1, 2024.

What penalties do individuals face for violating BOI reporting requirements?

- A person who willfully violates the Beneficial Ownership Information reporting requirements may be subject to civil penalties of up to $591 for each day that the violation continues.

- That person may also be subject to criminal penalties of up to two years imprisonment and a fine of up to $10,000.

- Potential violations include willfully failing to file a beneficial ownership information report, willfully filing false beneficial ownership information, or willfully failing to correct or update previously reported beneficial ownership information.

- For additional information regarding penalties, visit https://www.fincen.gov/boi-faqs.

Where Can I Learn More?

You can find guidance materials and additional information by visiting the following:

- Beneficial Ownership Information FAQs – https://www.fincen.gov/boi-faqs

- BOI Reporting Key Questions PDF – https://www.fincen.gov/sites/default/files/shared/BOI_Reporting_Key_Questions_Published_508C.pdf

*This article was published in December 2023 by the U.S. Department of the Treasury Financial Crimes Enforcement Network